Aggies1322 said:

Heineken-Ashi said:

Aggies1322 said:

ac04 said:

all banks are facing similar issues right now because they all hold huge portfolios of tanking CRE and worthless long term bonds. its cute that you think whichever bank you work for is immune, but its also delusional.

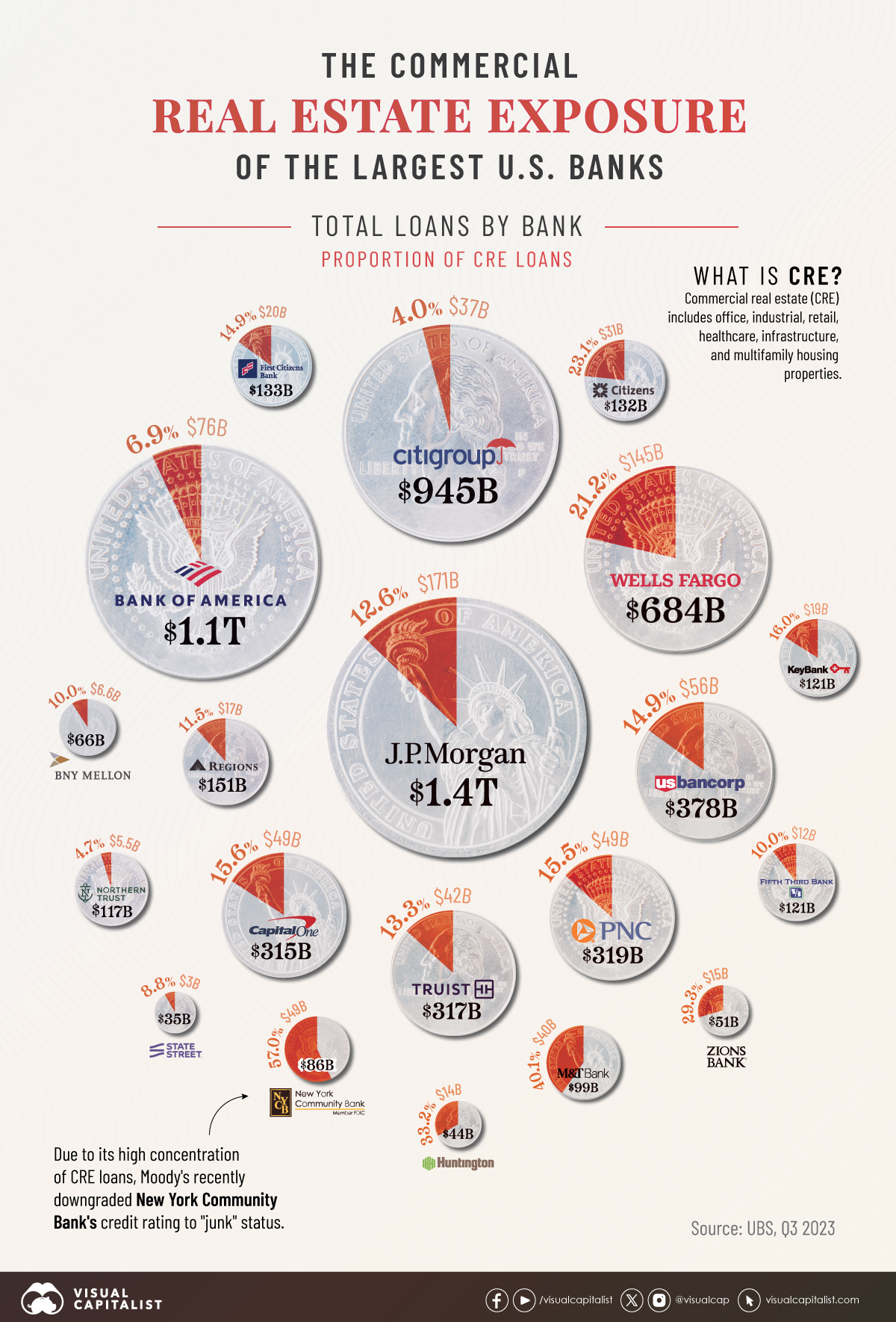

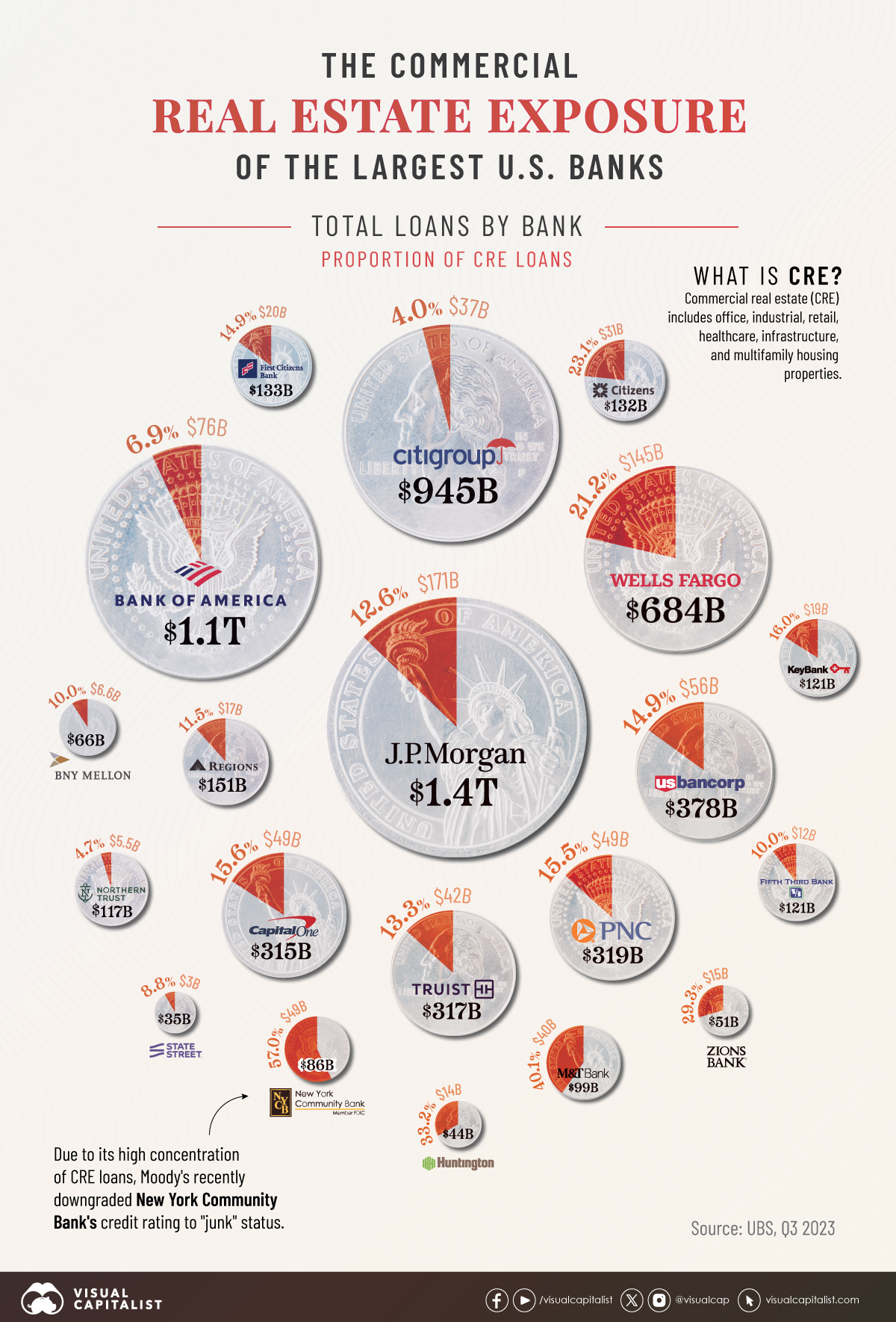

I think I'll be okay. You just keep screaming that the sky is falling. What % of assets does CRE make up for the money center banks (hint: less than 10%)? Your concern is with the regionals..

That is as a % of their loan portfolio, not total assets. But either way, I think you should look up what regionals are sitting at for CRE as a % of portfolio.

I'm very aware, thank you.

I think you need to take a good look at the faith you have in a sector that is facing more systematic risks than ever before at a time where the FED is operating at historic losses.

“Give it hell Heinekandle, I’m enjoying it.”

- Farmer @ Johnsongrass, TX

“No secure borders, no alpha military, no energy independence, no leadership and most of all no mean tweets - this is the worst trade I’ve ever witnessed in my lifetime. ***Put that quote in your quote/signature section HeinendKandle*** LOL!”

- also Farmer @ Johnsongrass, TX (obviously in a worse mood)